2026: When Sustainability Mandates Reach the Materials Layer

Executive Summary

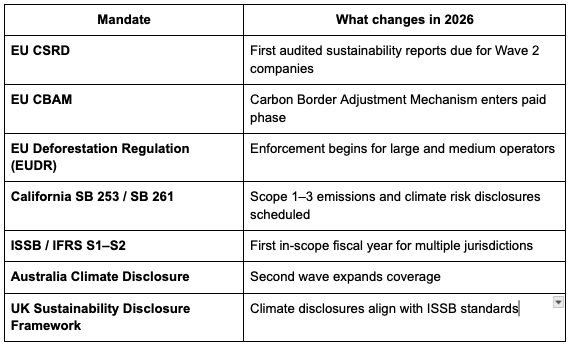

Beginning in 2026, a series of global sustainability mandates move from planning and disclosure frameworks into enforceable, audited, and financially material requirements. Regulations such as the EU’s Corporate Sustainability Reporting Directive (CSRD), the paid phase of the Carbon Border Adjustment Mechanism (CBAM), the EU Deforestation Regulation (EUDR), and ISSB-aligned climate disclosures expand accountability well beyond finished products and operations.

For manufacturers and brands, this marks a shift: materials and formulation inputs become part of regulated sustainability performance. Pigments, fillers, and additives—once treated as minor technical details—now influence Scope 3 emissions, traceability requirements, and environmental risk disclosures.

For years, sustainability regulation has existed mostly on paper—announced, debated, delayed, and partially implemented. That changes in 2026.

Across the EU, North America, and key global markets, a wave of sustainability mandates moves from frameworks and reporting pilots into enforceable, audited, and financially material requirements. For many companies, 2026 is the first year when environmental disclosures, carbon accounting, and supply-chain traceability stop being aspirational and start affecting procurement decisions, product design, and supplier qualification.

Key Mandates Taking Effect in 2026

Find Your Industry for Specific Impacts

Textiles

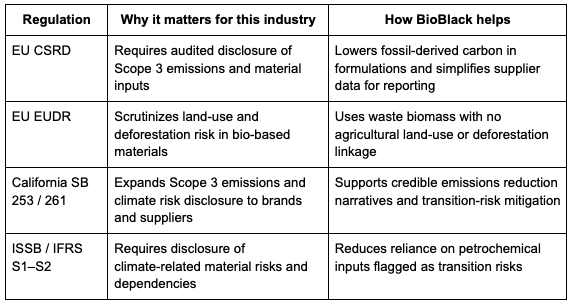

Textile brands are among the most exposed to Scope 3 emissions reporting and traceability requirements. Under CSRD, ISSB-aligned disclosure regimes, and emerging climate laws in the U.S., pigments and dyes now contribute directly to audited sustainability reports rather than sitting quietly in the background of product development.

As brands work to quantify product-level carbon footprints and demonstrate chemical responsibility, material inputs that were once considered interchangeable are increasingly scrutinized for both environmental impact and documentation quality.

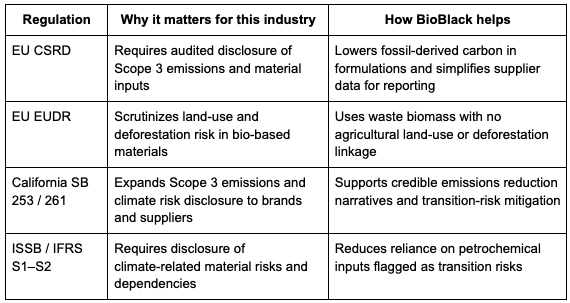

Key regulations impacting this industry (2026) and material implications:

Leathers (Natural and Synthetic)

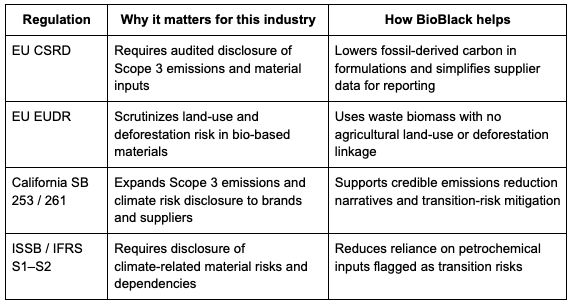

Leather supply chains—both natural and synthetic—are facing increased scrutiny around environmental impact, land-use risk, and chemical processing. Sustainability mandates coming into force in 2026 extend accountability beyond hides and polymers to include finishing, coloration, and treatment materials.

For leather producers and brands, this means formulation inputs increasingly factor into sustainability audits, supplier risk assessments, and climate disclosures.

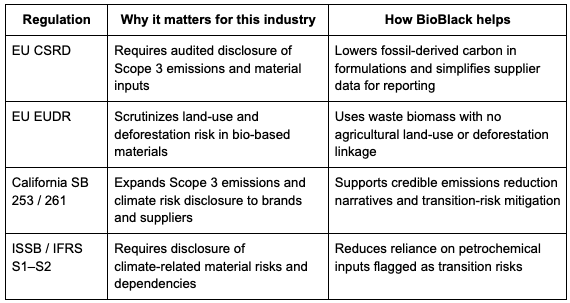

Key regulations impacting this industry (2026) and material implications:

Cosmetics & Personal Care

Cosmetics and personal care brands operate at the intersection of safety, transparency, and sustainability. As disclosure and green claims enforcement tighten, pigments and colorants are receiving renewed attention for both their origin and environmental profile.

Under 2026-era mandates, brands are expected not only to meet safety standards, but to clearly substantiate sustainability claims tied to ingredient sourcing and material composition.

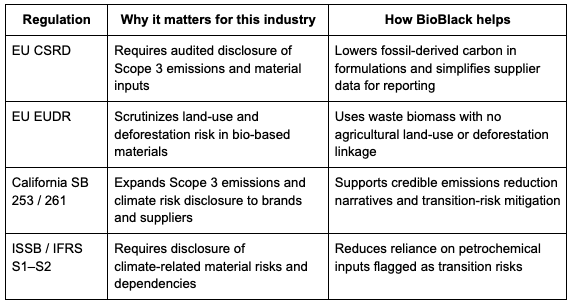

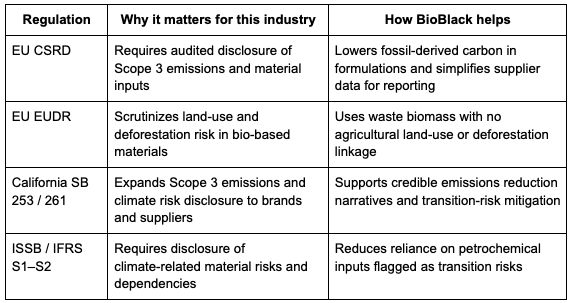

Key regulations impacting this industry (2026) and material implications:

Asphalt

Infrastructure and construction materials are increasingly evaluated through the lens of lifecycle emissions and embedded carbon. Climate-aligned procurement standards and disclosure regimes are pushing sustainability expectations into materials that were historically assessed only on performance and durability.

For asphalt producers, even incremental changes in formulation can influence emissions accounting at scale.

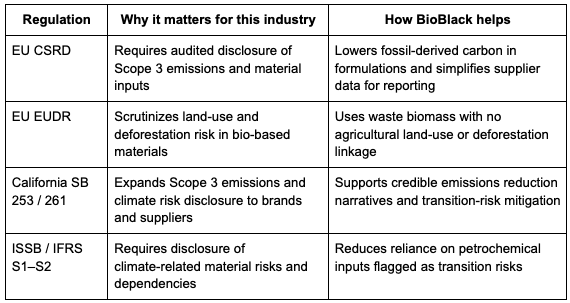

Key regulations impacting this industry (2026) and material implications:

Paints & Coatings

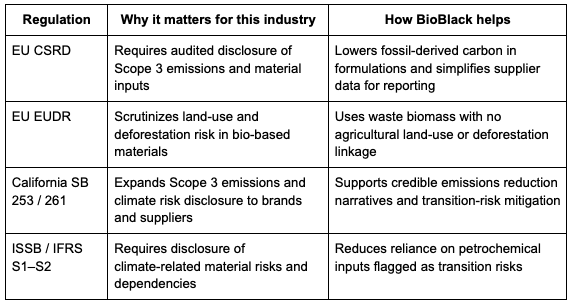

Paint and coatings manufacturers are navigating growing pressure to disclose the environmental impact of formulation inputs, not just manufacturing operations. Pigments, binders, and additives increasingly show up in Scope 3 emissions calculations and chemical impact disclosures.

As sustainability reporting becomes audited, formulation choices play a more visible role in regulatory readiness.

Key regulations impacting this industry (2026) and material implications:

Food Packaging

Food packaging sits at the intersection of safety, sustainability, and regulatory oversight. Beyond recyclability, brands and suppliers are being asked to disclose the carbon intensity and material composition of packaging components as part of broader sustainability reporting.

This places greater emphasis on pigments and additives that support both compliance and consumer-facing sustainability commitments.

Key regulations impacting this industry (2026) and material implications:

Packaging & Inks

Packaging and ink suppliers are increasingly expected to support brand owners’ sustainability disclosures with reliable, auditable data. Under CSRD and ISSB-aligned frameworks, supplier-provided information plays a direct role in audited reports.

Inputs that simplify reporting and reduce environmental risk are becoming a differentiator in supplier qualification.

Key regulations impacting this industry (2026) and material implications:

Plastics & Composites

Plastics and composite materials are central to Scope 3 emissions discussions and long-term decarbonization strategies. While pigments may represent a small percentage by weight, their impact scales across high-volume applications.

As carbon pricing and disclosure regimes expand, formulation-level decisions increasingly influence regulatory exposure.

Key regulations impacting this industry (2026) and material implications:

Looking Ahead

The significance of 2026 lies not in the introduction of sustainability regulation, but in its material consequences. As reporting becomes audited and carbon costs become tangible, supply-chain materials move from background decisions to regulated performance drivers.

Material choices made today, like switching to BioBlack, will shape how smoothly companies navigate the sustainability landscape ahead.